-

Partner/Headhunter | Branchy

-

Senior Product Manager | Bakken & Bæck

-

Finance Manager (vikariat) | StartupLab

-

Data Engineer | Klaveness Digital

-

Medeiere* | Boitano AS

-

Chief Operating Officer (COO) | ROEST

-

CEO | Kontur AS

-

VP Marketing | Glint Solar

-

Ingeniører innen kontroll, elektronikk og datasyn | Munin

-

Senior Developer | Klaveness Digital

This graph shows what's wrong with Norway? How the Norwegian startup companies are performing.

By Per Buer, founded Varnish Software in 2010 and served as CEO and CTO there. In 2016 he co-founded IncludeOS where he's the CEO.

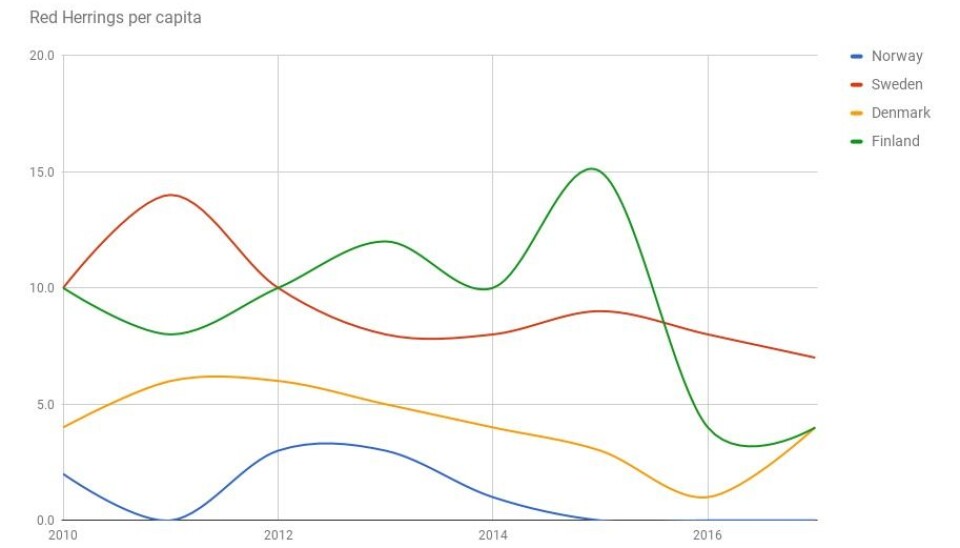

We’re hearing quite a bit about how the Norwegian startup scene is getting stronger, year by year. We’re also hearing stories about how the startup scene in Sweden is very strong, probably doing quite a bit better than Norway. Sweden currently have six unicorns and we don’t have any.

In order to get some metrics on the matter I’ve been keeping an eye on various awards given to startups. In my previous startup, Varnish Software, I was lucky enough to be nominated for a 2013 Red Herring EMEA award. We and about 150 other startups were gathered in Amsterdam and 100 of us got a reward. Hanging out with other entrepreneurs is always fun and we absolutely had a great time.

Since Red Herring EMEA publishes a list of their winners year by year you can use their data to figure out how countries in Europe perform according to Red Herring. They have published their winners back to 2010. If we include 2017 we have a total of 700 winners. That is a pretty decent group and we should be able to learn something from that data. There are lots of caveats here - winning a Red Herring likely isn’t a fair and objective indicator of a successful startup.

Furthermore, one might argue that different cultures put different values on winning competitions like this. Maybe the finns are overly found of the spotlight? But it is an indicator and if nothing else we can see if there are any trends here.

Hardly any Red Herrings at all

So how does Norway rank when it comes to Red Herrings? On average we get 1.13 Red Herrings per year. If we adjust for population that gives us one winner per 4.5 million people. If we compare it to mainland Europe it is slightly worse than the UK (3.8M) but better than France (5.5M) and far better than Germany (9.2M) and Spain (10.0M). Italy (32.2M) and Greece (19.3M) are really struggling, having hardly any Red Herrings at all.

So how well are our Nordic neighbours doing? Denmark is doing really well at 1.4M capita/Red Herring. That is about 3x as good as Norway is doing. Sweden is doing even better with about 1.0 capita/Red Herring. Finland is totally crushing it with 0.6M capita/Red Herring.

There seem to be a trend here. It can roughly be summarized as “our neighbours are doing a lot better than we are”. Ten years ago we could afford to ignore it as oil price was >$100 a barrel and these indices mostly didn’t take off shore startups into account.

Surprising result

One thing I found surprising is how well Finland was doing. Finland hasn’t been doing too well when it comes to the number of investment rounds conducted (See sources: The #nordictech Funding Report Q1 2017) or the number of successful exits (Creandums 2016 exit report).

Not surprising the Swedes are doing very well here. And their strong performance see to be consistent across just about every benchmark for startups I’ve seen.

So, figuring out how Sweden is different is key. There are more startups per capita there then just about anywhere else. And quite a few of them are successful enough to make it to a growth round. I expect there to be quite a bit of feedback here. If you keep hearing about local successful startups you’re more likely to do a startup yourself.

Access to old money

I believe this is due to better access to growth capital than anything else. Sweden have long traditions in growing capital intensive businesses, dating way back when family money was the only source of capital available for growth. Keep in mind that historically Sweden managed to get some very capital intensive business up and running during the last 50 year. SaaB and Volvo weren't cheap.

A lot of this money came from old family fortunes. Norway, hasn’t got any significant amount of family money - at least not ones that are keen to invest in risky technology startups. Being a colony for 600 out of the last 700 years likely didn’t help the matter as money was siphoned away by Denmark and Sweden.

If we talk to some of the leading tech companies in Norway today, companies that were founded in the 80s, 90s and early 00s access to capital was almost non-existent.

State owned companies in Norway

The biggest companies in Norway (Statoil, Hydro, Telenor, Yara, DNB) have been at least partly state owned. So, the capital generated here doesn’t find it’s way into private wealth. Having found oil also meant it was very, very hard for small companies to entice investors to invest in them when they had the option of investing in the offshore activities. Investing in oil has until very recently been a pretty good bet.

We’ve yet to see if the slump in off shore investments will result in a strengthening of norwegian startups. Already it is significantly easier to recruit senior programmers and my hope is that access to capital will improve as well.

We need more multi-millionaires

So where am I going with this? What can we do to spur people into quitting their jobs and pursuing their startup dream? I personally believe it is mostly about money. Mostly private money. Government money is fine, but with private money comes a harder commitment. We need more multi-millionaires that have so much money they don’t what to spend it on.

As they get bored of their exuberant houses in Bydøy, their luxurious yachts and ridiculous large mountain cabins they will seek recognition and validation of their business skills and at least some of them will be drawn into angel and venture funding. Sure, quite a few of them will spend money and time pouring expensive champagne down the drain at Champagneria and will never invest in anything exciting. But a few of them are in the position where they have skills and money to help startups succeed. This success will mean that they’ll get even richer and might even be more obnoxious.

New incentives

The incentives put forward by our current government are a good step forward. Small angel investments will be tax deductible. But we need to address the stigma that today follows obscene amounts of money. And if you’re stinkin’ rich you can help out buy applying your skills and your excess wealth by helping others realize their dreams. This way we can, as a society, forgive your exuberant splurging of money,

Private wealth isn’t always subtle. But without it I don’t see how we can get this ball rolling without it.

Sources:

Aggregated stats scraped of the red herring website:

https://docs.google.com/spreadsheets/d/1lZ_AkvTClWo-FgjfRvc4snzgdg4dRyb_ynTJ_259w70/edit?usp=sharing

http://www.nordictechlist.com/reports (login required)

Creandum 2016 exit report: https://www.dropbox.com/s/4v5mli29ptfde3f/Creandum%20Nordic%20Exit%20Analysis%202016_v4%20(1).pdf?dl=0

http://shifter.no/index.php/2016/06/08/dette-er-tallene-som-far-enkelte-til-a-si-at-norge-er-det-nye-sverige-og-oslo-er-det-nye-stockholm-men-det-er-langt-igjen/

http://shifter.no/index.php/2017/01/24/160-prosents-okning-antall-tech-investeringer-norske-selskaper-2016-sverige-vokser-raskere/